ADU FINANCING

How to finance a granny flat in San Diego

What are ADU financing options?

Many folks are currently sitting on low interest rates for their primary home, meaning a refinance is not appealing. In those situations, a “Fixed Rate Second Position Loan” might be a good option.

Read on for more on various lending options, plus other paths for ADU financing in California. We’re happy to work with you and your lender to ensure you have the plans, scope of work, and budget required to submit for loan documentation on construction loans.

Best ADU financing options

Home Equity Loan

A home equity loan (related to a home equity line of credit or HELOC) is typically the simplest way to finance an ADU, though expect rates to be higher like everything else right now. Primary residences can typically have up to 80-90% Loan-To-Value (“LTV”). So if your home is appraised at $700K and your current loan is only $400K, you could expect to access a credit line of $160K (80%*$700K= $560K-400K). A home equity loan often allows for flexibility, as you can draw down the credit line as you need the funds – you are only charged interest on the amount of credit used.

Fixed Rate Second Position Loan

A newer loan product available is based on the value of your home after you add the ADU (“after renovation value”). No refinancing of your existing loan is required and terms are up to 20 years, plus there are no “draws” like a construction loan. You receive the entire loan amount upfront. After the renovation is completed, the appraiser visits the home to issue a certificate of completion. Read more about fixed rate second position loan options.

Construction Loan

If you don’t have much equity in your home or already have a loan value close to the conforming limit of $977,500, a construction loan could be a good option for ADU financing. The construction loan will cover the building costs and then once construction is completed, the construction loan rolls into an adjustable rate mortgage (ARM), which means it is a refinance of your original mortgage. Loans typically have interest-only payments during construction with no interest due until the line is actually drawn down once the project starts. These loans are available for owner-occupied properties and rental properties alike.

Renovation Loan (203K or Homestyle)

Renovation loans allow homeowners to finance a renovation project (including ADUs) into the mortgage. Fannie Mae Homestyle allows for construction of detached ADUs. The loan has a conforming limit of $977,500 and may be based on the “future value” of the property after adding the ADU, which will be based on appraisals (not rental income). Renovation loans typically offer up to 95% financing of a primary residence or 85% of an investment property.

Renovation loans can also be packaged with a loan for the purchase of a property. You can choose to refinance it after construction completion to get a better interest rate or different loan amount. Lenders will often handle this refinance without additional fees. Jumbo construction to permanent single-close loans are also available with up to 95% LTV.

Cash-Out Refinance

A cash-out refinance replaces your existing mortgage with a new home loan for more than you currently owe on your house. The difference goes to you in cash that can be used on guest house construction or other renovation. You must have equity built up in your house to use a cash-out refinance. Limits are typically at 80-90% of your home’s equity (and more strict due to COVID). So if your home is worth $1M and you currently owe $600K… you could likely get a loan of up to $800-900K for a cash-out opportunity of $200-300K.

Home Equity Conversion Mortgage (HECM, ages 62+)

Also known as a reverse mortgage, an HECM is possible when at least one of the owners is 62 or older and the property is a primary residence. Owner can borrow up to 42% of home at age 62, all the way up to 70% at age 86 or older. Any existing loan would need to be paid off with the new one, and remaining money from the new loan can be used on the primary residence or on an investment property. The loan is structured as a line of credit and the borrower has access to the line with no fund control requirements (e.g. no construction draws required). Also, interest is tacked onto the balance of loan…so no debt service is due before or during construction.

How can I compare ADU loan options?

Looking for granny flat financing in San Diego? Use our ADU financing calculator to look at several different loan options, including Renovation Loans, HELOCs, and Cash-Out Refinance. You can include the estimated costs for your ADU that are based on our actual plans and prices. We want to help you get the numbers you need to make an informed decision on building and financing your ADU in California. If you don’t already have a lender, we are happy to put you in touch with experienced preferred providers we regularly work with on granny flat financing.

Can the future value of the property after adding an ADU be used to qualify for a higher loan value?

Yes, this is possible. The Fannie Mae Homestyle Conventional Renovation loan program can be used for purchase of a property and construction of a detached ADU. The loan amount may be based on the future value of the home, i.e. after adding the ADU. The max loan amount is $977,500 (Fannie Mae limit for 2023). Investment properties can be up to 85% financed, while primary residences may be up to 97% financed.

Here’s an example of “maxing out” that loan potential while building an ADU:

- To max out the loan value, we’d be looking for a property with a future value of $1,150,000 (=$977,500/85%) for an investment property… you could go over the limit, but would have to put in more cash

- Let’s say you choose an ADU that has all-in costs of ~$400K

- That leaves about $750K for the purchase of the property (=$1.15M-$0.4M), if the investor didn’t want to pay for any construction costs out of pocket

- The investor would be responsible for a down payment of ~$172K (=15%*$1.15M)

Can the potential income of an ADU be used to qualify for a higher loan value?

Yes, this is possible. As of October 2023, the Federal Housing Administration (FHA) announced lenders can now include income from ADUs when underwriting a mortgage.

- For properties with an existing ADU: up to 75% of estimated ADU rental income can be counted for borrowers qualifying for an FHA-insured mortgage.

- For adding a new ADU through construction: 50% of the projected rental income can be included under FHA’s 203(k) Rehabilitation Mortgage Insurance program.

This opens up additional avenues for financing and makes ADUs an even more attractive investment. As of November 2022, Freddie Mac is offering a program for 1-3 unit properties. This makes it possible to purchase or refinance (for instance, out of a construction loan) while factoring in the rental income from the ADU towards the value of the property. There is no seasoning period required for refinancing, meaning you can initiate the financing as soon as you have a rental contract signed for the ADU.

Does SNAP ADU work with construction financing?

Yes, we work with you and your lender to ensure you have the required plans, scope of work, and budget required to submit for loan documentation to get approval for a construction loan.

Once the project is started, we will also handle the coordination of the loan documents with the lender, including managing inspections and “draws” during construction. Draws are payments by your lender that are tied to construction progress milestones. Your construction loan balance will increase as the bank releases the loan funds to your contractor to pay for work completed this far. This means that you don’t typically pay interest on the entire amount of the loan upfront, but only on the portion “drawn down” thus far.

How much detail do I need to have for the lender in order to get construction financing for an ADU?

In our experience, we’ve found it to be sufficient to produce an intended floor plan and elevations, plus scope of work along with a budget that specifies the full construction costs. Fortunately, all of this information is provided in our Feasibility Report and is the first step of kicking off your ADU Design + Build with us.

After you submit the plans & budget to the lender, they will then order an appraisal, which will typically take into account the value of the “future state” of the property after adding the ADU. If a lender has worked with the contractor in the past, it can be a smoother process since the lender is familiar with the documentation & work of the builder.

If you are looking for a property to construct an ADU on, we suggest asking the seller for an extended due diligence period if possible. This allows you more time to research the feasibility of the project you intend to do (e.g. complete a feasibility report to understand any special site requirements that may affect project cost) to ensure you have enough financing for your ADU.

Additionally, we are unique in offering a Price Lock Guarantee after the Feasibility Study, which means you won’t need to worry about your price going up and not having sufficient ADU financing for the build.

What is the CALHFA ADU grant program?

The California Housing Financing Agency (CalHFA) offers an ADU Grant Program that provides up to $40,000 to reimburse pre-development costs associated with the construction of an accessory dwelling unit, including site preparation, architectural designs, permits, soil tests, impact fees, property survey, and energy reports.

Who is eligible for the CalHFA ADU Grant Program?

Homeowners with low or moderate income are eligible for the program. Currently the household income limit in San Diego County is $211,000. You can use any type of loan or cash to build your ADU and receive the grant.

In order to qualify, you must also live in and own the property where you are building the ADU.

What if I already paid for part of my ADU expenses?

The grant money may be reimbursed if you already paid for costs before applying for the grant.

The program is new and some process are being worked out, and SnapADU is supporting half a dozen clients who are currently in process of getting a grant.

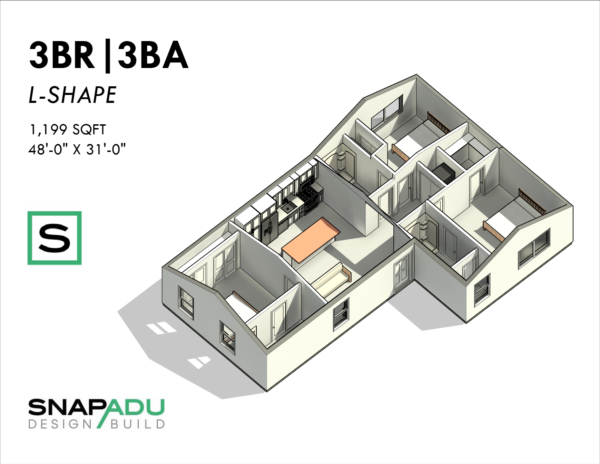

ADU Plans and Pricing

Check out our ADU floor plans for full pricing estimates on each model, or consider going for a custom ADU. We’re big on transparency and want you to be prepared with the expected all-in cost for building your accessory dwelling unit so you can secure the right ADU financing as needed. It’s never too early to bring us in to the conversation for a free consultation as you think through options.