So you’ve decided to build an accessory dwelling unit in your back yard for a family member. Fantastic! Read on for important financial, legal & logistical questions to consider as you think about how to move forward with building your new granny flat.

1. What are financing options and restrictions?

If you plan to finance the construction of your ADU, options are typically based on home equity, income, savings and your credit. Popular ADU financing options include a Home Equity Line of Credit (HELOC), Fixed rate 2nd position loan, Homestyle Renovation Loan, or a 2nd Position Construction Loan. An important factor will be the size of the loan on the existing home; if it is a jumbo loan, the property may be maxed out on getting additional credit. The overall plan & timing for moving into the ADU is also important.

Example: Let’s say “Mom” takes out a HELOC on her existing home to build the ADU on the property of her “Kids.” If she then sells her home (to move into the ADU), “Mom” would have to pay off the HELOC at the point of selling the existing home. So “Mom” would need to have sufficient equity in her existing home to pay off the HELOC and pay for the ADU.

2. Can we finance the ADU separately from the main house?

Unless you are using a separate line of credit (backed by another property or securities), financing options for the ADU will also be tied to the property along with the primary house. Homestyle Loans and most Construction Loans would ultimately require the refinance of the overall property once the ADU is constructed. “Mom” would be associated with the mortgage debt if she is on the loan.

Example: Let’s say the “Kids” own the primary house and “Mom” wants to finance an ADU in the back yard. Unless it’s a line of credit not associated with the property, it’s not possible to get a loan for “just” the ADU independent of the primary dwelling, since an ADU cannot be titled separately. An option to consider would be to have “Mom” contribute payments for the ADU, which you could manage “internally” whether she is on the mortgage documentation or not. More on ramifications for title later.

3. Can a family member gift funds to a relative for the development of an ADU?

Under the IRS tax code, any person can give an annual gift of up to $15,000 tax free to an individual. Called an “annual exclusion,” the amount is per person.

Example: A couple (your parents?) could give a combined $30K a year to you without having to file a gift tax return. Also, if it’s near the end of the year, they could give $30K in December and $30K in January. They could give another $30K+$30K to your spouse, hitting $120K.

4. What about using investments to pay for the ADU?

One option would be to take money out of investments to fund the ADU. This can be costly, as typically the funds are considered earned income or capital gains, which are taxable. You may be able to plan distributions to your advantage across calendar years if construction of your ADU will be happening near the beginning of a year.

Example: ADU construction is slated to start in January, meaning most of the costs of the ADU will be due in that year. You could consider taking out half of the required ADU funding in December, with the balance coming out of your investments as-needed in the next calendar year. This could help to reduce a large tax hit all in one year. Read more about ADU tax considerations.

5. Who should go on title for the property?

If a family member is paying for the ADU, they may want to protect their investment in the ADU on the property (whether or not they elect to live in the ADU). After the ADU is built, it could make sense to hold title as “tenants-in-common.” This arrangement would allow a split interest, which could take into account the ADU investment value compared to the overall property value after development of the ADU.

Example: Assume your home is valued at $750,000 and your family member contributes $250,000 for the development of an ADU on your property, which increases the property value to $1 million (or more). It may make sense to transfer 25% of the title on your property to your family member to help preserve their investment in the ADU.

6. What do I need to know about split interest in title?

By adding the new party to your title, you will likely need to add the family member to your deed of trust and mortgage accordingly. This will mean that any future decisions you and your family make will require your family member to sign off on the change. An Estate Attorney can help create a legal document that specifies “Mom’s” investment in the ADU so that if there is any change in the future, “Mom” could reflect where her funding has been invested.

Example: After the development of your ADU, your overall property value has been appraised at $1.1 million. You decide to refinance to take cash out. In this case, the lender will require all parties, including your family member who is now on title, to sign off on the refinance. This would also be true when you are ready to sell your home down the line, since your family member would be required to sign off on the sale of the home.

7. What should be handled with an estate plan?

If your home is already in a family trust and you self-finance the construction of your ADU, then the ADU should be covered under the umbrella of the existing family trust that covers the property. Estate Plans (which include a Will and Trusts) are considered “private contracts” and are not recorded; the documents will not become publicly available information like a recorded lien would be. Another option would be to draft a “Trust Deed with Assignment of Rents” recorded against the property. By recording this Trust Deed, “Mom” has given (public) notice to any and all current and future lenders and lien holders about her ownership in the property.

Which path is best? It is up to “Mom” to determine how much she wants to formally protect her investment. It is of course important to speak with your personal attorney to review all pertinent details of your situation.

Example: If the “Kids” sell or refinance the property, any involved lenders will require that “Mom’s” recorded deed be addressed or paid out as part of completing the transaction. With a non-recorded legal document in the family’s estate plan, the lender would not be aware of the arrangement and thus would not make the requirement that “Mom” be accounted for.

8. What considerations should be taken into account during the design phase?

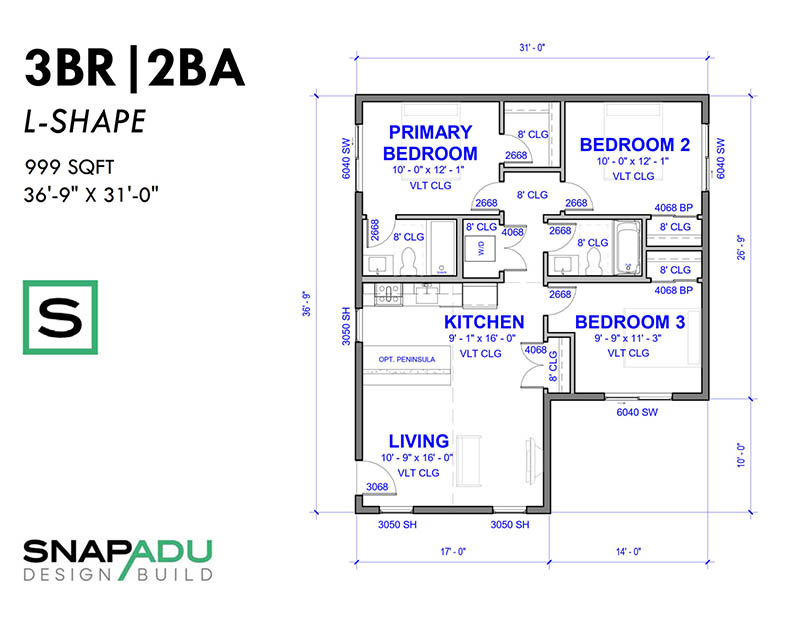

The overall size and shape of the ADU, as well as the placement on the property, will have ramifications on the living experience in the main house. During the design phase, consider different ADU floor plans and site plan configurations to help flush out any concerns well before construction is underway.

Also, many people are building ADUs for family members who want to “age in place.” While some modifications can readily be made later, many design elements need to be incorporated during the pre-construction phase. You may want to consider if a semi-custom or a custom ADU is right for you.

Example: Design considerations for accessibility could include an open floorplan for easy maneuverability, step-free entries and flush thresholds, wider doorways, lever-style door handles, curb-free shower with grab bars, and adding ramps to outdoor areas.

Browse Floor Plans for Inspiration

Try checking out standard floor plans to find something close to what you are envisioning. You can mark up plans to share with your ADU designer. This approach helps expedite your design process and reduce costs.

1 Bedroom Floor Plans

2 Bedroom Floor Plans

3 Bedroom Floor Plans

4 Bedroom Floor Plans

Two Story Floor Plans

9. What are the impacts on utilities and maintenance?

Once the ADU is built, the maintenance and holding costs related to the ADU will come in to play. ADUs are required to have access to solar, either from the primary house or with a separate array on the ADU. Some points to discuss ahead of moving into the ADU could include how to split utilities, yard maintenance, and any other shared resources.

Example: Who is responsible for upkeep on the shared lawn? For utilities, is it worth spending the money to add a separate meter vs. prorate bills? Should “Mom” and “Kids” co-invest in adding solar on the main house that the ADU could draw from, or should “Mom” just put solar on the ADU? How about property tax obligations?

10. What other questions should we be thinking about?

ADUs offer an incredible option for many multi-generational families. Setting expectations ahead of moving into the ADU can help ensure everyone is on the same page about lifestyle decisions and responsibilities. One suggestion is to use a hypothetical “renter” as a model to think through ideas in a more neutral way, for instance thinking of “Mom” as the “renter” of the ADU. This may help promote discussion about topics you’d otherwise miss looking at it with a parent/child mindset.

Example: What will be our norms for spending time together, e.g. do we eat together every night? How do we handle having space for guests, e.g. should we alert each other about upcoming visits? What are expectations for gatherings, e.g. any concerns with loud music, drinking, parking, etc? If there are grandchildren, what is the expectation about babysitting? Who can decide if the house should be sold? Do we get a separate address?

The Cohab Workbook: Families by Harry Margolis is an excellent worksheet to help you think through additional questions with your family. Putting important information in writing ahead of time will help make the transition to multigenerational living a smooth one. You may also want to review our guide to ADUs as a replacement for assisted living.

Special thanks to Dianne H., Kristen H. and Brad B. for sharing their insights & experience for this article.

0 Comments