An Accessory Dwelling Unit (ADU) is more than just an added structure on your property—it represents potential rental income, increased property value, and versatile living or working space. But with this significant investment comes a barrage of questions about taxation, insurance, and financial implications in the Golden State. Before diving deep into ADUs’ tax-related intricacies and insurance needs, it’s pivotal to have a foundational understanding of their implications in California’s property landscape. Here’s a comprehensive guide to tax breaks, property tax adjustments, and insurance requisites related to ADUs, with a particular focus on recent changes and California-specific nuances.

Does adding an ADU increase property taxes in California?

Yes, an accessory dwelling unit will generally increase property taxes. But adding an ADU does not affect the taxes on the primary residence (there is no reassessment of the main home). Keep reading to understand the full tax implications of adding an ADU.

How is property tax calculated for an ADU in California?

A new assessment for your accessory dwelling unit is added to the existing assessment for the property. This approach is commonly referred to as a “blended assessment.” This means that when it is time to assess your post-build property, only your ADU will be examined and your primary house will not be reassessed. Thus, the original value of your home will not be touched, and only the ADU value will add on.

How much does an ADU increase property taxes in California?

Generally, property tax rates on ADUs are in the range of 1-1.5% on the build cost. So, for example, if the construction cost of your additional unit is $300K, you might expect to pay around $3,000 in additional taxes per year. Be sure to consult with a tax professional to confirm the impact in your specific scenario with a California ADU property tax adjustment.

Throughout California, newly constructed ADUs are assessed at market value as of the date of completion. Typically in the San Diego area, assessors will use the cost of construction to value the new guest house. Often assessments value the improvements at “wholesale” costs, e.g. considerably lower than it actually cost to build the guest house.

How will San Diego County reassess my property after constructing the ADU?

The San Diego County Assessor’s Office receives copies of all building permits issued by the cities as well as the County. The Permits are then divided into two categories: (1) permits for repair, replacement and maintenance, and (2) permits for actual new construction. In addition to obtaining the building permit information, the Assessor’s Office mails out a questionnaire to the property owner seeking information on the specific cost of construction and the actual size of the addition.

For new construction, there is typically a reassessment for the new square footage added. In appraising new construction, the market value of the addition is determined by the Assessor’s Office and added to the value of the existing property. The value of the existing property does not change. For example, a homeowner currently has a 2,000 sqft home and builds a new 500 sqft ADU. Under Proposition 13, the County can only reassess the new ADU, and not the existing home.

When will the value of the ADU be added on to my taxes?

All municipalities must notify the County Assessor’s Office whenever building permits are issued. After the reassessment for new construction has been completed by the assessor’s office, the property owner is notified in writing of the new assessment. Since changes are reflected on the next regular property tax bill, it can take up to a year to run through the process before the new tax assessment becomes active.

California state law also requires the assessor’s office to appraise all new construction on January 1st to determine the value for property tax purposes. This taxable value is then reflected on the next regular property tax bill. As with a change-in-ownership, the owner is notified of the new assessment and can appeal the value.

How will building an ADU affect my personal taxes in California?

An ADU will increase your property value, and with that your property taxes. However, using your casita wisely can also increase potential for tax deductions on your individual tax return. Simply building an accessory dwelling unit may not immediately affect your taxes, but the way you use your ADU – such as for a rental or for an office space – can lead to the opportunity for yearly deductions and credits.

Can I deduct the cost of the ADU from my taxes?

When you ultimately sell your property, you would be subject to capital gains taxes, as you are with any home. But keep in mind that if the property is considered your primary residence, you may exclude up to $250,000 (or $500,000 for married couples filing jointly) of your capital gains from taxes. So unlike a separate investment property that does not count as a primary residence, you would enjoy a tax shelter when it comes time to sell a property with an ADU. This is one of the many reasons an ADU can be a great investment.

Your gain will be calculated as: Home’s selling price – Selling Costs – Tax Basis. And what is the tax basis? That would be your original purchase price for the home, plus expenses related to the purchase, plus the cost of capital improvements (like adding an ADU!) , minus depreciation and insurance payments.

For example, let’s say you and your spouse bought a house for $1,000,000, with purchase expenses of $20,000. You add a large ADU at a cost of $380,000. You later sell the property for $2,000,000 with selling costs of $100,000. This would mean you would owe zero capital gains tax. ($2M sell price – $100K selling costs – $380K improvements – $1M purchase price – $20K purchase expense = $500K – $500K deduction = 0).

Can you write off an ADU from your personal taxes every year in California?

As mentioned above, the simple act of building an ADU will not have an effect on your individual taxes. Instead, it is the added value and potential for income that alters the amount you are taxed, as the space is then considered a part of your income-earning business.

If you choose to run your small business out of your newly built accessory dwelling unit, you may be able to depreciate part of the construction of your ADU, as well as any work you put into the space (so long as it is related to your business).

Similarly, you will be able to deduct expenses such as utilities, maintenance of the home, and additional upgrades to your ADU if you choose to rent it out. Keep in mind that this rental income will be subject to income taxes.

Down the line when you decide to sell your house, you will be able to write off your guest house construction costs at that time, given the change in value and the cost of the improvements you made as described above. Again, it is always best to consult a tax professional before taking any action regarding your property and its value.

What is the county assessor’s form as it relates to an ADU?

Once the county is aware of the ADU completion via the building permit, they will mail a form titled “Property Owners Declaration of New Construction.” State law requires property owners to provide construction costs to the assessor’s office for tax assessment purposes.

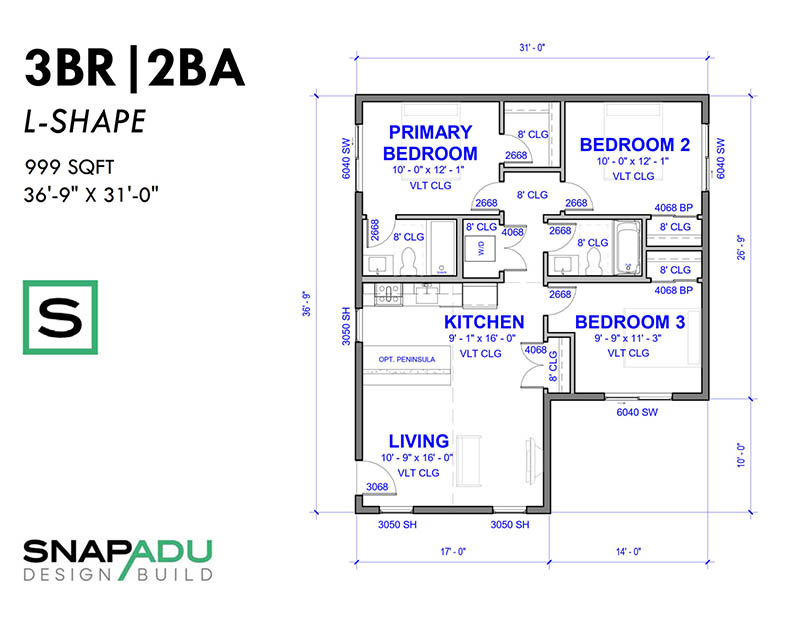

You will be asked to fill in the following information in the form: construction costs, total bedrooms and bathrooms after adding the ADU, the the type of new construction.

- Describe Type of New Construction: example: “Construction of new detached, one bedroom, one bathroom, 491 square foot accessory dwelling unit.”

- Total Bedrooms and Bathroom: Add the ADU bedrooms and baths to the primary dwelling unit count for the revised number.

- Construction Costs: Use $130.58 x ADU Square Feet

Although you may have specific costs for your ADU construction, we are noting that jurisdictions in Greater San Diego typically use a standardized value per square foot for valuations. The often-used rate is $130.58/SF. However, in February 2023, the International Code Council updated the rate to $149.80/SF (February 2023 Building Valuation Data, ICC). Still, several cities continue to use the $130.58/SF rate in their valuations (February 2021 Building Valuation Data, ICC).

Depending on when the unit is completed, the form may arrive quickly or may take some time. Regardless, the County Assessor monitors all building permits and will mail you a form.

Is ADU insurance necessary for my new unit?

While some homeowner’s policies might already cover secondary structures like sheds, it’s frequently found that ADUs need distinct additional insurance coverage. Hence, it’s crucial to speak directly with your insurance carrier to discern what is incorporated within your current policy and what might necessitate additional coverage for your ADU.

Do I need to inform my homeowners insurance company if I’m adding an ADU to my property?

Yes, it is recommended that homeowners contact their homeowners insurance provider to understand the impact of an ADU project on their insurance. Standard home insurance doesn’t usually cover renovations or new construction. Depending on the size and scope of your project, you should plan on adjusting coverage to make sure the new ADU is covered if it is damaged. Homeowners insurance will not pay for damage to the ADU unless the unit is directly covered by the policy.

The best time to finalize insurance for the ADU with your carrier is after you have the closed out building permit card. This card is what demonstrate compliance the ability to legally occupy the ADU. The insurance company should provide an application which will ask for items including type of construction, bedroom and bath count, square footage, roof type and other specifications.

Is the ADU insured during the build out?

Indeed, your ADU does have a certain level of coverage during its construction phase. If damage arises due to the builder’s negligence, it’s generally taken care of by the General Liability or Umbrella Policy that a reputable general contractor should have in place. However, for damages stemming from natural events or other property-related issues—think of a tree falling on the ADU—it’s not usually chalked up to negligence. Such incidents would be under the purview of other insurance types, possibly homeowner’s or builder’s risk. Always a good move to double-check specifics with your insurance provider.

Does SnapADU carry builder’s risk insurance?

SnapADU doesn’t carry builder’s risk insurance. That said, clients have the option to secure a distinct policy for their project during the construction phase. It’s worth noting that builder’s risk policies can come with a steeper price tag. Plus, any damage costs not covered by either homeowner’s insurance or SnapADU’s General Liability might not even hit the deductible mark, making it potentially less economical to claim.

Reach out to experts for your unique situation

The insights shared in this technical blog are derived from our extensive expertise in the field, encompassing hands-on experience in design, development, and implementation. We are committed to delivering accurate and current information; however, it’s important to acknowledge the dynamic nature of the ADU space, which may lead to changes affecting the details discussed in this blog.

SnapADU is dedicated to empowering our readers with valuable insights and practical knowledge, enabling them to navigate the constantly evolving accessory dwelling unit landscape. We invite you to connect with our experts to receive personalized guidance and to remain informed about the latest advancements within the field.

0 Comments