California law states that every single family-zoned property is allowed one accessory dwelling unit (ADU) and one junior accessory dwelling unit (JADU) converted from existing space in the home. For multi-family properties, the law allows up to two detached accessory dwelling units as well as conversion of existing space into ADUs.

In the City of San Diego, it is also possible to build additional ADUs under the “Affordable ADU Bonus” program, created in response to a California mandate for jurisdictions to incentivize construction of affordable ADUs. Read on for the requirements of the ADU bonus program. Also check out our first permitted bonus ADU project with stacked units. We’ve used much of our real experience through that permitting process to develop this blog with information that was previously not available to us.

How many ADUs can you build under the ADU bonus program in San Diego?

The Affordable ADU Bonus program allows the construction of one additional unrestricted ADU (meaning the unit may be rented out at market rates) for every ADU deed restricted to the level of moderate income households for a period of 15 years, or restricted to the level of low income households for 10 years.

If you are within a Sustainable Development Area (SDA), there is no specific limit to the number of bonus ADUs you can build. Outside the SDA, you may build one affordable ADU and one unrestricted ADU. On a single-family property, this means you could have a total of three ADUs (plus a JADU, but we don’t recommend those to investors, as they come with an owner occupancy requirement). On a multifamily property, this means you could have a total of four detached ADUs (or even more inside the SDA).

However, in all cases, the number of bonus ADUs allowed will also be limited by the floor area ratio (FAR, how many square feet of living space can be developed on the property in relation to the lot size), lot coverage, setbacks and height requirements of the underlying zone in which the property is located.

In other words, the total living space and building mass allowed would be the same as the original zoning. This is of course so that properties are not developed beyond the character of the neighborhood… but will also allow for increasing density on properties that were perhaps under developed given their lot size.

What is the deed restriction requirement under the affordable ADU program?

Deed restricted ADUs will have moderate income affordability limits in place for 15 years, or just 10 years if restricted to low income. After that period, you can rent out the ADU at market rates. For a single-family zoned property, the affordability restriction will be on title in second lien position. For a multifamily zoned property, the affordability restriction will be on title in first lien position. Keep reading for more restrictions & considerations to make sure you understand the requirements.

What can be a rent rate for an affordable ADU? What is the low- and moderate-income limit for ADU tenants under the program?

The San Diego Housing Commission publishes annual income and rent calculations for each income level. Below is the chart showing those rates. Note that all these rates are considered the “gross rent,” and that if the tenant is to pay any utilities, a utility allowance must be deducted as well. Or if the property owner decides to include utilities in the rent, the gross rent figure could be used.

Note that the affordable rent rate for a unit is based on the bedroom size of the unit (this interpretation was verified by the San Diego Housing Commission SDHC via phone conversation in October 2023). For instance, a 3BR unit could be rented at a rate of $3,213 with a 15 year restriction, or at a rent rate of $2,067 for a period of 10 years. The income limits come into play when verifying income for perspective tenants, more on that in the next section.

2023 Income and Rent Limits for San Diego County

Source: SDHC and Snap ADU (updated October 2023)

What are the verification requirements on income?

Property owners shall submit income verification to the San Diego Housing Commission (SDHC) before tenants move in so that the SDHC can determine eligibility of the tenants. Income information must be submitted annually to confirm continued eligibility under the program. If incomes increase beyond the limits, tenants will be asked to vacate within six months when their income reaches certain levels (typically about a 25% increase… but keep in mind the income limits area also increased each year).

As an example, let’s say you decided to rent out your 3BR unit at a moderate level of $3,213 for a period of 15 years. For your applicants, their income limit would be based on their family size and also the level of restriction (e.g. moderate in this case). So two people applying could have an income of up to $102,800 in the moderate scenario.

What happens if a household starts making more income and no longer meets the threshold?

According to the SDHC as of November 2023: In case a household becomes ineligible (due to increased income or assets), the owner has 180 days to initiate eviction procedures. During this period, the tenant pays market rate rent, and the owner must pay the difference between this and the affordable rent to the Commission. This fee payment period is capped at six months. Failure to comply with these requirements can result in a material default under the agreement.

What are other key points of the Affordable Bonus ADU Agreement I will need to sign?

It’s important to highlight several key restrictions that apply to the Affordable ADU:

- No Related Renters: The Affordable ADU cannot be occupied or leased to the owner, any relatives (by blood or marriage) of the owner, anyone employed by the owner, or anyone connected to any entities involved in ownership of the property.

- Student Dependents: The Affordable ADU may not be leased to student dependents, as defined in the U.S. Internal Revenue Code, unless their taxpayer guardian resides in the same unit.

- Property Ownership: Individuals or households that own real property are not eligible to occupy or lease the Affordable ADU.

- Liquid Asset Limitation: Eligibility is restricted to persons or households whose liquid assets do not exceed 110% of the annual Area Median Income. Liquid assets include cash, savings, marketable securities, etc., but not inaccessible retirement funds.

Note that the above requirements were applicable to projects we have seen work through the SDHC as recently as November 2023, but these rules may change.

What is the application process for the San Diego ADU Bonus Program?

ADU project plans will be submitted to the City of San Diego Development Services Department (DSD). The DSD will confer with the SDHC on eligibility. They achieve this review by assigning an SDHC reviewer to the project, typically within a few days of submitting to the city.

If the project meets the guidelines, the SDHC will draft the affordable housing agreement and deed of trust for recording the restriction on the property. SDHC will also sign off on the building permit for the units so that the construction may commence. The application is $600 and there is a $150 annual fee to verify income of the tenants.

Per the SDHC in August 2023:

- SDHC would begin their review when the permit is routed to us by the City of San Diego.

- When we are ready to proceed, we would issue a conditions letter, provide an ADU Bonus Application, and a project invoice to begin the agreement drafting process.

- We begin the agreement drafting process once we have reviewed the project and have no corrections or questions about the project itself.

- The agreement drafting process can take anywhere from 60-90 days to complete, and we do not sign off on any building permits until we receive a recorded ADU Bonus Agreement.

While the 60-90 days might seem prolonged, it could run concurrently with other review processes, which can be beneficial. For instance, if there’s a three-review process involving two 30-day reviews and 15 days of revisions, this covers 75 days. Thus, the actual waiting period might be on the lower end, especially when professionals (like us) are involved.

How can I find out if my property is in a Sustainable Development Area (SDA)? What about Transit Priority Areas (TPA)?

Sustainable Development Area (SDA) replaced Transit Priority Areas as the definition for where affordable ADU development may occur (Feb 2023). SDA is more expansive than the TPA. Use this interactive Sustainable Development Area map to see if you are located in an SDA.

You can also use this interactive Transit Priority Area map to see if you are located in the TPA. Be sure to click the box on the right under Content -> Transit Priority Areas to turn on the map layer. Remember that even if you are not within a TPA, you may still be able to build one affordable ADU and a market rate ADU, so long as you conform to the FAR and lot coverage requirements.

What are the design requirements for ADUs under the affordable program?

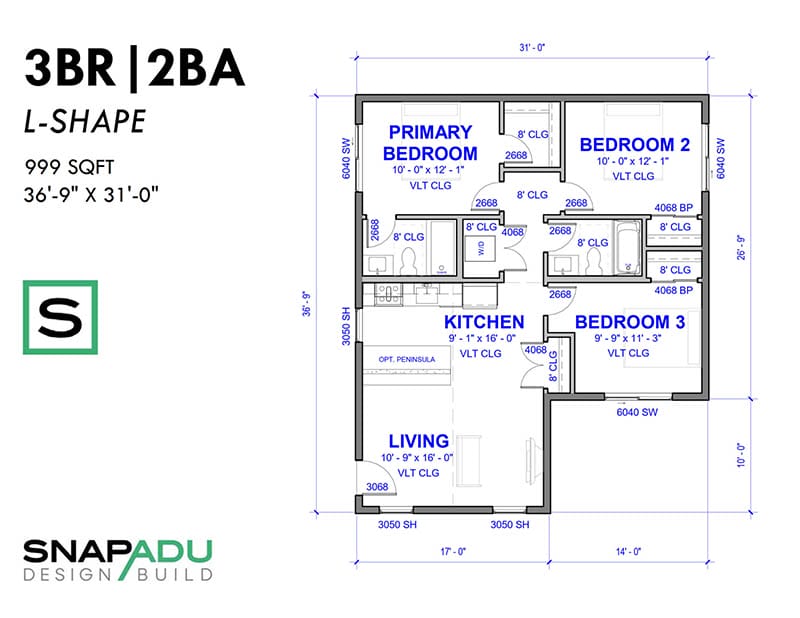

The deed restricted affordable ADUs must be of comparable size, mix of bedrooms and amenities to the market rate ADUs on the property. This is interpreted to mean that the affordable units must be within 15% of the square footage of the market rate unit size you are constructing, or within one bedroom of the units (when the sqft is the same in the market rate and affordable ADU). Many investors would simply build the same unit for all of the ADUs to simplify their rental portfolio. Read more about renting out ADUs.

How can I best fit multiple ADUs on my property?

The number one tip to fitting multiple units on a property is to stack units. The City of San Diego ADU regulations allow for stacking ADUs, so long as height and fire rating requirements are met. For instance, you must keep an external staircase at least 5’ away from structures and property lines (though you could choose to enclose the staircase and enjoy smaller setbacks). Another option is to build ADUs as a duplex, e.g. sharing a common wall.

Still looking to acquire property so you can build an ADU? Check our our guide about the ideal lot for an ADU.

How much will it cost to build multiple units?

There are some economies of scale when building multiple units, since we will be building more square footage yet mobilizing the same number of subcontractors required to construct a single unit. However, you will be constructing multiple expensive rooms, for instance kitchens and baths that have costly plumbing & finishes. This means the overall cost per square foot may still be moderate, especially if the units are small 1BR or 2BRs. Also, you will require fire rating between units, more robust foundation and framing, as well as stair access to upper units.

As a rule of thumb, the Vertical Build cost of each additional ADU will be approximately 15-20% less than the prices listed on our website for a single unit.

We would be happy to provide a detailed proposal for your project factoring in all of these ADU cost considerations. The first step is to fill out a Project Assessment so we can give you ballpark pricing. If that looks roughly on target to you, we will dig into more details of your lot to refine the highly variable sitework costs so we can produce a full Proposal. From there, we would kick off the ADU Feasibility Study to verify all of the project costs and produce a final Price Guarantee for the design, permit and build of your ADU project.

Reach out to experts for your unique situation

The information presented in this technical blog is based on our extensive expertise in the field, drawing from our hands-on experience in design, development, and implementation. While we strive to provide accurate and up-to-date information, it’s essential to note that the rapidly evolving nature of the ADU space may result in changes that could impact the details discussed here.

At SnapADU, our goal is to equip our readers with valuable insights and practical knowledge to navigate the ever-changing accessory dwelling unit landscape. We encourage you to reach out to our experts for personalized guidance and to stay updated on the latest developments in the field.

0 Comments