You may have heard that California has made it much easier to build an accessory dwelling unit (ADU, also known as a guest house, granny flat, casita, additional unit, or in-law suite) on most residential properties throughout the state. But is an ADU a good investment? Does an ADU add value to your home in California? Whether you are a professional investor or a homeowner looking for your first opportunity to generate rental income, the answer depends on a number of factors, and we’d like to spark some ideas for you as you are considering all the “puts and takes” of adding an ADU in Greater San Diego.

Is an ADU a good investment?

Yes, for many homeowners, an accessory dwelling unit can be a strong investment. To determine if an ADU is a good investment, you will want to understand the costs for the size unit you want to build. Learn all about ADU costs here. Then, you will want to understand the anticipated effect of the ADU on the property value and also on the potential rental income for the property, as well as ADU tax implications.

For instance, if you are building an ADU on your primary residence, you will also enjoy an important tax deduction when it comes time to sell the property. On the sale of a primary residence, you may exclude up to $250,000 (or $500,000 for married couples filing jointly) of your capital gains from taxes. So unlike a separate investment property that does not count as your primary residence, when adding an ADU you would enjoy a tax shelter when it comes time to sell the property.

Read on for our thoughts on all the considerations when assessing if it is worth it to build a guest house on your property and how to value building an ADU.

How much does an ADU increase property value?

As in real estate more broadly, the value add of an ADU will be affected by comparable sales in the area. One study from Porch showed that in large cities, a property with an ADU is typically priced 35% higher than a home without an ADU.

Constructing an ADU on your property typically increases the resale value of the property, since the house will be appraised with other homes with ADUs. An appraiser will use the value of properties with ADUs to determine the value of your own. Properties with an ADU sell for a premium since they include an income-producing unit and more square footage of livable space on the property.

While we are still early in the adoption of ADUs on a wide scale, it is becoming easier to find properties sold with guest houses. New appraisal guidelines are also making it possible for appraisers to include ADUs as part of their assessment of a property, which should start leading to more consistent valuations for ADUs.

A permitted ADU may be added to your title insurance report and will invariably increase your property’s value, both for the increase in square footage and as an income producing property. A tiny home or an unpermitted ADU will not be picked up on a title report and the property owner will only realize the value of the income production from renting the unit.

How much value does an ADU add in California?

To determine ADU value, one rule of thumb we’ve seen used is that a newly constructed accessory dwelling unit will add 100 times the monthly rental value to your home. So if an ADU will be rented out for $3,500 a month, it might add around $350,000 to the value of the home. So, does an ADU add value to your home in California? Yes, but this will of course vary widely on a case by case basis.

“For people on the fence about building an ADU, I tell them that an ADU is a good idea if they are looking for valuable cashflow now, plus long-term appreciation in at least a three to five year timeframe,” says Sherry Chen, an ADU specialist and Realtor at Compass. “If they plan to sell in a shorter time frame, then they might risk not seeing their ROI pan out.”

Read about 8 benefits of building a backyard home for other positives beyond property value appreciation.

How will an unpermitted ADU affect my property value?

You may be tempted to cut costs when building your ADU; many folks have asked what happens if you build an ADU that is unpermitted, perhaps on the weekends if you are handy.

What is often forgotten is that an unpermitted ADU will not show up on an appraisal of your property. If the accessory dwelling unit is not included in the appraisal, it may limit your pool of buyers when it is time to sell the property. Many buyers will make a financed offer, meaning the home will need to appraise at the purchase price in order for the buyer to secure the loan. Building a permitted ADU allows an appraiser to include the value of the guest house in the appraisal associated with resale of the property, which invariably leads to more competitive offer prices from buyers when it is time to sell.

Further, having an ADU helps the property appraisal when refinancing the home, which may provide homeowners with equity they otherwise wouldn’t have had available. (Read more about financing options for ADUs)

What is the return on investment (ROI) for an ADU?

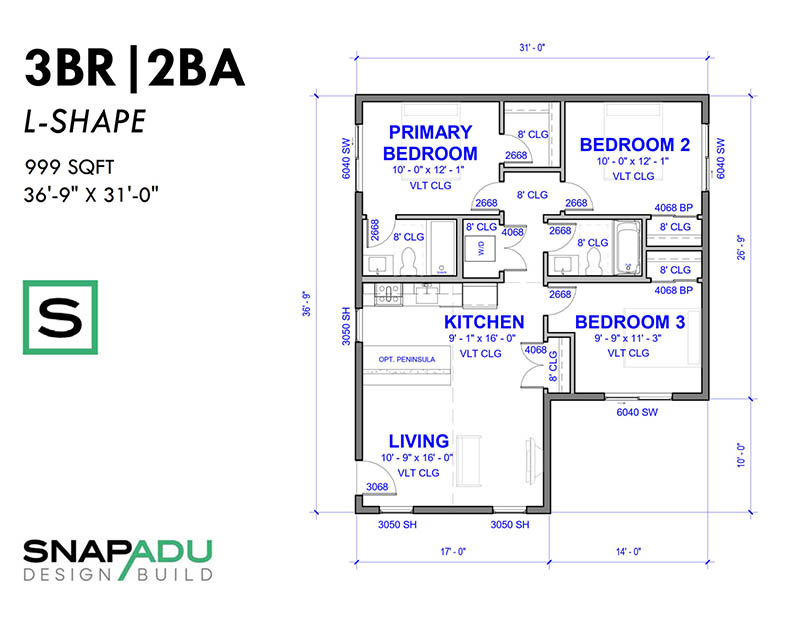

ADUs have the potential to be a great return on investment from a cashflow perspective. A 1000 square foot 3 bedroom / 2 bathroom ADU that costs about $430,000 to build (all-in for design, permits, sitework, construction, typical other improvements like utilities) can be rented for $4,500+ per month in much of Oceanside and Carlsbad, for example.

When thinking about your true return on investment, be sure to budget for maintenance costs, taxes, and insurance. In this example above, that’s still close to $45,000 per year in your pocket. Unleveraged cash-on-cash returns would easily hit 10% on the full build cost of the ADU. You could also finance the construction; even at a rate of 8% in the above example, you would net $8,200 annually if you financed all of the construction and came out of pocket just for design & permits (about $20,000). That’s an ROI of 41% on your invested capital in the ADU project.

Refinancing at a more favorable rate down the road would further boost these returns. Moreover, this analysis doesn’t even take into account the property value appreciation due to the added ADU, which offers additional financial upside when you decide to sell.

ROI for an ADU in San Diego: CHART

2BR/1BA (750 sqft) | 3BR/2BA (1000 sqft) | |

|---|---|---|

| Source: SnapADU Oct 2023 | ||

| RENT (monthly) | $3,500 | $4,500 |

| Vertical Build + Finish Materials | $275,000 | $340,000 |

| Sitework Cost | $25,000 | $25,000 |

| Typical Additional Work | $30,000 | $45,000 |

| Design | $10,000 | $10,000 |

| Permits/Fees | $7,500 | $10,000 |

| TOTAL COST | $348,000 | $357,000 |

| Gross Annual Rent | $42,000 | $54,000 |

| Maintenance, Vacancy, Insurance (10% gross) | $4,200 | $5,400 |

| Property Taxes (1% total cost) | $3,480 | $4,300 |

| NET INCOME | $34,320 | $44,300 |

| Cash on Cash Return (net income / cost) | 10% | 10% |

| FINANCED EXAMPLE | ||

| Loan Amount | $330,000 | $410,000 |

| OUT OF POCKET COST | $18,000 | $20,000 |

| Total Annual Interest (8% rate) | $29,057 | $36,101 |

| NET INCOME | $5,263 | $8,199 |

| ROI (net income / cost) | 29% | 41% |

Can I get a better deal if I build ADUs on several of my properties?

We work with investor clients, as well as families building ADUs for their household. Investors often ask if there is a benefit to building ADUs on different sites, in the same neighborhood, for example. While there will be some cost savings to this since a single project manager could check in on both projects, 95%+ of the costs will remain unchanged. One place you can see cost savings is if you are in an area that will allow multifamily properties – which may have TWO detached ADUs – stacked or attached to each other. This would mean that we can save on some design costs, as well as enjoy some scale benefits of building a larger foundation vs. two smaller ones, for example. Read more about what your city will allow for ADUs.

0 Comments